Version 1.01, October 2019

There is a hint of frost in the air and the leaves are changing colors. You are at the Farmers’ Apple Market to buy and sell bushels of apples. Today, the local authority has decided to collect a tax of €15 for each bushel of apples sold. 1

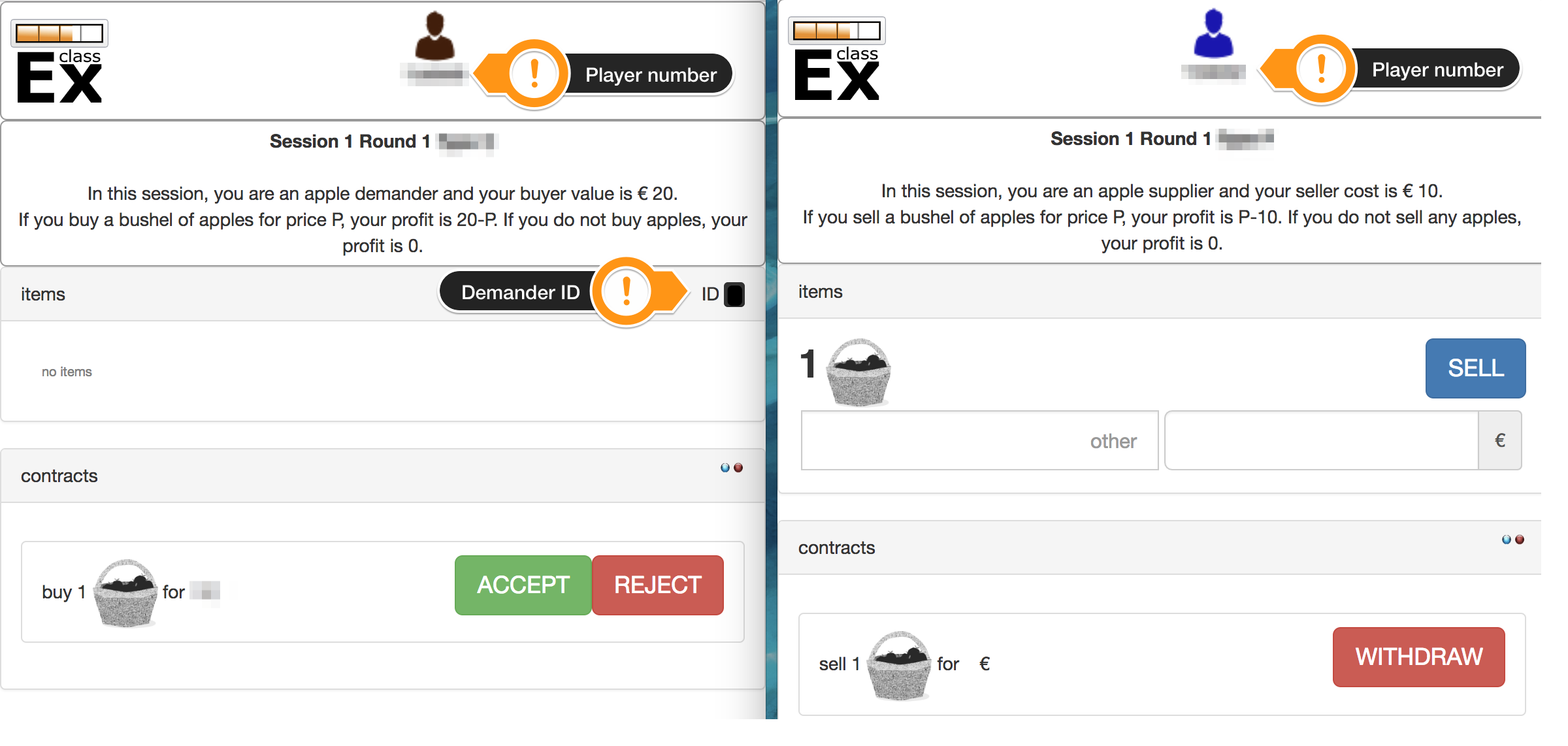

You will be either a supplier or a demander in each market session. (see Figure 1).

Your objective is to make as much profit as possible. Profit will be measured in “laboratory currency units”, though we will denote the units with the s€ign.

There will be three market sessions today. You are likely to play a different role in each of the three sessions, but the overall distribution of buyers and sellers in the market is the same in all three sessions; that is, the total number of buyers with each possible Buyer Value and the total number of sellers with each possible Seller Cost, will be the same in all sessions.

In the first session, there are no taxes. If you are a supplier, you can sell at most one bushel of apples per round. If you sell a bushel of apples for a price \(P\), and your Seller Cost is \(SC\), then your profit is the difference, \(P-SC\). If you do not sell, your profit is zero.

If you are a demander, you can buy at most one bushel of apples per round. If your Buyer Value is \(BV\), and you buy a bushel of apples for a price \(P\), your profit will be \(BV-P\). If you do not buy, your profit is zero

In the second session, sellers have to pay an excise tax of 15€ if they make a sale.2 In this session, if you are a seller with Seller Cost \(SC\) and you sell a bushel of apples for \(P\), then your profit on the transaction will be \(P-SC-15\).

In the third session, buyers have to pay a per unit excise tax of 15€ if they buy a bushel of apples. If you are a buyer with Buyer Value \(BV\) and you buy a bushel of apples for \(P\), then your profit on the transaction will be \(BV-P-15\).

If you make no transactions at all, you don’t have to pay a tax and you have no costs or revenue, so your profit is zero. Observe that you do not have to sell or buy, and that zero profits are better than loses.

Sellers and buyers must find each other and agree on a price. If they reach an agreement, the seller should type the price and the buyer ID into her screen and click the "SELL" button. The buyer must accept the offer to finalize the contract. The sales contract is then displayed as accepted in the contract section.

Click here if you need information on how to trade in classEx .

After reading the instructions for this experiment, please check your understanding by answering the following questions and recording what you expect to happen. Answers to the warm-up exercises can be found at the end of the document here.

Suppose that sellers have to pay a tax of 15€ when they sell a bushel of apples. If a supplier who has a Seller Cost of 5€ sells a bushel of apples for 25€ to a demander who has a Buyer Value of 45€, the supplier will make a profit of: . And the demander will make a profit of: .

Suppose that buyers have to pay a tax of 15€ when they buy a bushel of apples. If a supplier who has a Seller Cost of 5€ sells a bushel of apples for 25€ to a demander who has a Buyer Value of 45€, the supplier will make a profit of: . And the demander will make a profit of: .

You are a supplier with a Seller Cost of 15€. Sellers have to pay a tax of 15€ when they sell a bushel of apples. What is the lowest price at which you would not lose money by selling apples?

You are a demander with Buyer Value of 30€. Buyers have to pay a tax of 15€ when they buy a bushel of apples. What is the highest price at which you can buy a bushel of apples and not lose money?

Before participating in an experiment, it is useful to think about what you expect to happen and to to record your prediction. After the experiment, look back at your notes and compare your expectations with what actually happened. If you are surprised by the result, reflect on your priors and the theory and see if you can make sense of your new experience.

In the experimental market, would you predict that the 15€ tax paid by sellers in Session 2 will cause the average price paid by buyers to increase by more than 15€, less than 15€, or just about 15€?

Will demanders be better off if sellers pay the tax or if buyers pay the tax?

Answers to Warm-Up Exercises: W.1 5€ and 20€; W.2 20€ and 5€; W.3 30€; W.4 15€; W.5 and W.6 ask for your expectations.

If you played the Apple Market Experiment before, today’s market session is a little more complex. Instead of just two types of buyers and sellers, there will be several types of each. This should make shopping a bit more interesting than before. It shares with the Apple Market that buyers and sellers can buy or sell at most one unit, and that the distribution of Buyer Values and Seller Costs are the same in all sessions.↩︎

An excise tax is a per unit tax imposed on a particular good or service.↩︎